![]()

Written By Liz Eggleston

Course Report strives to create the most trust-worthy content about coding bootcamps. Read more about Course Report’s Editorial Policy and How We Make Money.

Overview

Course Report is happy to present our sixth Market Sizing Report, another in-depth, empirical study that takes stock of the coding bootcamp industry each year. Course Report polled every full-time, in-person US/Canadian bootcamp with courses in web and mobile development, gathering statistics on 2018 graduates and projected 2019 graduation rates. Our response rate was once again impressive: 93% of schools responded.

This year marks the 7th anniversary for the coding bootcamp industry, and the number of coding bootcamp graduates continues to grow since the first bootcamps launched in 2012. Coding bootcamps are a $309 million industry and will graduate ~23,000 developers in 2019.

Key Findings

Coding bootcamps will graduate over 23,000 students in 2019 and are ramping up Online & Corporate Training in 2019. Course Report found:

- In 2019, the coding bootcamp market will grow by 49%, to an estimated 23,043 graduates in 2019, up from 15,429 in 2018. (1)

- Trend Alert: 29 bootcamps work with partners on corporate training; this year, these 29 bootcamps expect to teach an additional 22,549 students via 995 corporate training partners (growth of 34% since 2018).

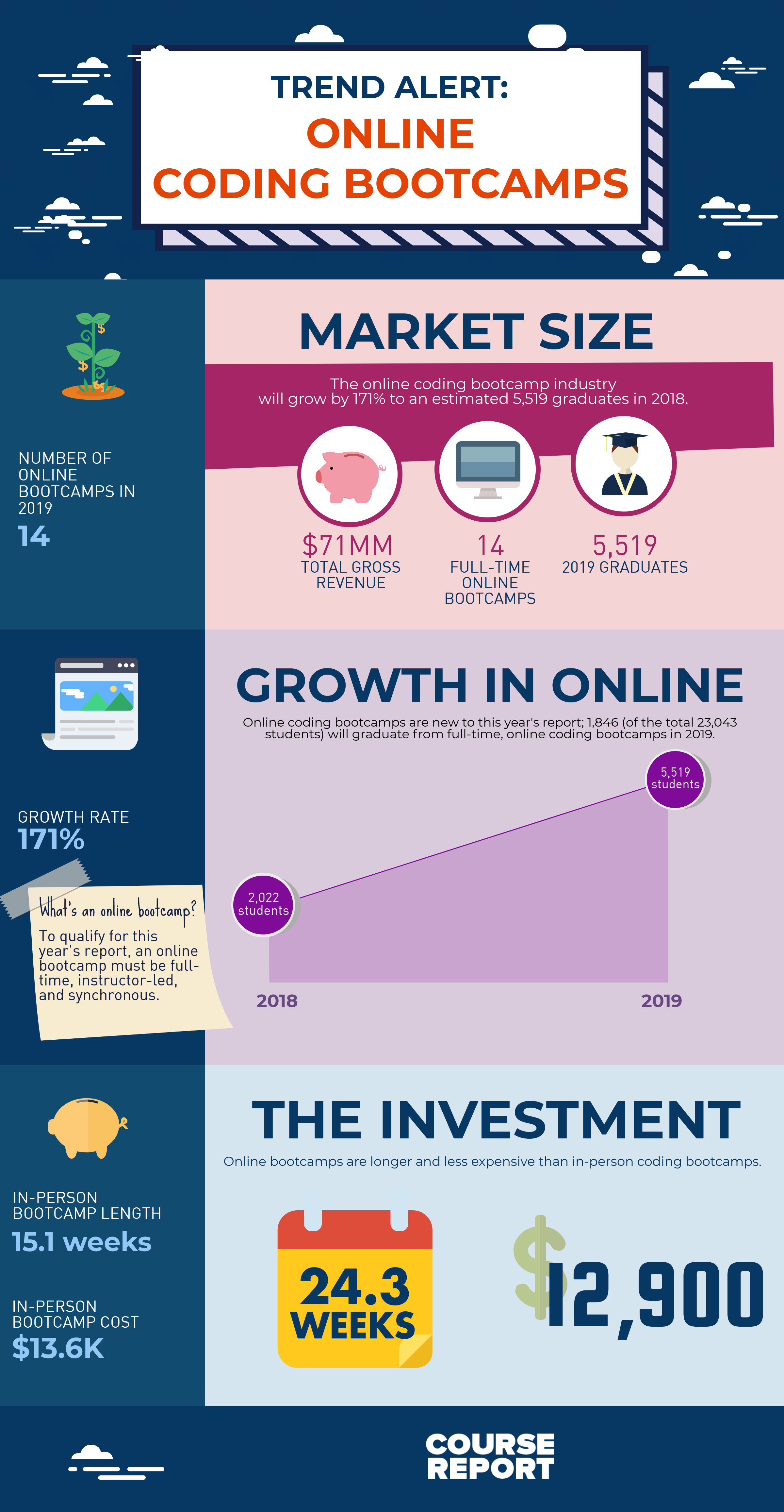

- Online coding bootcamps are growing even more quickly than in-person bootcamps; 5,519 (of the total 23,043 students) will graduate from full-time, online coding bootcamps this year.

- As a point of comparison, we estimate that there were 93,427 undergraduate computer science graduates from accredited US universities in 2018. (2)

- In 2019, there are 96 in-person bootcamp providers and 14 online bootcamp providers. As of June 1, there are coding bootcamps in 71 US cities and 38 states.

- Average tuition price of qualifying in-person courses is on the rise – $13,584, with an average program length of 15.1 weeks. Online bootcamps are slightly less expensive ($12,898) and much longer (24.3 weeks).

- We estimate that tuition revenue from qualifying schools will be $309,237,750 in 2019 (not including corporate training revenue) – this includes $71,186,477 from online schools in 2019. Trend Alert: 23 bootcamps offer Deferred Tuition or Income Sharing Agreements in 2019.

- This year, Full Stack JavaScript continues to be the most common teaching language, used in 44% of Web Development courses.

1 Note: the 2017 figure does not include online coding bootcamp graduates.

2 We estimated undergraduate CS graduates by using the 2017 Taulbee Study, published by the CRA (https://cra.org/wp-content/uploads/2018/05/2017-Taulbee-Survey-Report.pdf). The Taulbee Study is a survey of PhD-granting departments, released annually in May. The National Center for Science and Engineering Statistics compiles statistics on undergraduate degrees, but hasn’t published statistics since 2011. We assumed that Taulbee captured 26% of the total undergraduate degrees, based on the most recent comparison published at http://cra.org/crn/2012/11/counting_computing_cra_taulbee_survey_and_nsf_statistics/.

Results

Market Size

We find that coding bootcamps continue to put more resources into training new developers through Corporate Training partnerships. In 2019, 29 bootcamps report that they have corporate training partnerships. Tables 9 & 10 show the growth of this category.

| # graduates | |

|---|---|

| 2018 graduates | 16,779 |

| 2019 graduates | 22,549 |

| Growth Rate | 34% |

| # partners | |

|---|---|

| 2018 partners | 674 |

| 2019 partners | 995 |

| Growth Rate | 48% |

Comparison to 2018 Study

Accuracy

Our 2018 Market Sizing Study projected the 2018 market size of in-person coding bootcamp graduates to be 18,470 graduates. Our 2019 study finds that the actual market size in 2018 for in-person graduates was 13,407 graduates. Thus, in-person coding bootcamps overestimated their 2018 growth by 37.76%.

Our 2018 Market Sizing Study projected the 2018 market size of online coding bootcamp graduates to be 1,846 graduates. Our 2019 study finds that the actual market size in 2018 for in-person graduates was 2,022 graduates. Thus, online coding bootcamps underestimated their 2018 growth by 8.7%.

Teaching Languages

*note: these findings apply to in-person courses only

Web Development coding bootcamps have historically been taught using Ruby on Rails, Full-Stack JavaScript, .NET/C#, Java, Python, or PHP. In 2019, Full-Stack JavaScript has maintained its position as the primary teaching language. 44% of courses reported Full-Stack JavaScript as the primary programming language (Chart 1a). Not only are schools new to the market choosing JavaScript, but established bootcamps are also migrating their curricula to emphasize JavaScript.

Chart 1a: Top Full-Stack Web Development Teaching Languages by Courses

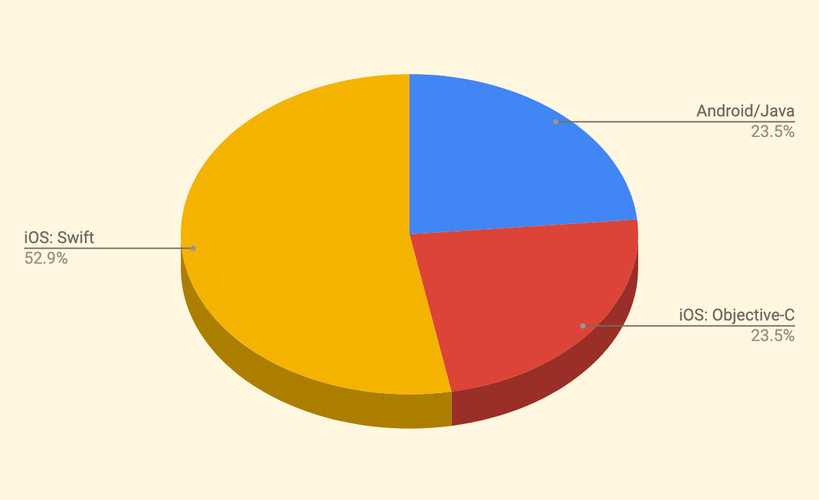

Mobile Development coding bootcamps have historically been taught using Java (Android), Objective-C (iOS), or Swift (iOS). In 2019, 54% of Mobile Development bootcamps teach iOS with Swift (Chart 1b), marking a shift from Objective-C to Swift.

Chart 1b: Top Mobile Development Teaching Languages by Courses

This year’s market sizing report includes bootcamps that provide coding-specific curriculum with a focus on Full-Stack Web Development, Mobile Development, or Front-End Web Development. Of these three career tracks, Chart 1c shows the continued popularity of Full-Stack Web Development – 94% of coding bootcamp grads learn Full-Stack Web Development (Chart 1c).

Chart 1c: Top Career Tracks by Graduates

Tuition

Tuition ranges from free to $28,000 for an in-person course, with an average tuition of $13,584. Courses range from 4 to 104 weeks with an average of 15.1 weeks, but most courses are in the 12 week range. Our study focuses on full-time programs, where students typically commit at least 40 hours per week, between classroom and programming time. The average Online bootcamp costs $12,898 and lasts 24.3 weeks.

| Tuition | % |

|---|---|

| Free | 8% |

| Less than $5,000 | 2% |

| $5000 - $9,999 | 15% |

| $10,000 - $14,999 | 44% |

| Greater than $15,000 | 31% |

| Schools offering Deferred Tuition | 11 |

| Schools offering Income Sharing Agreement | 5 |

Based on our estimate of 17,524 in-person graduates in 2019, we estimate tuition revenue for in-person schools at $238,051,273 in 2019, excluding rebates and scholarships.

Based on our estimate of 5,519 online graduates, we estimate revenue for online bootcamps at $71,186,477, excluding rebates and scholarships.

Trend: Alternative Tuition Models

In 2019, 23 schools offer alternative tuition options like deferred tuition, income-sharing agreements, or employer-sponsorship.

- 6 schools offer deferred tuition (students pay back a fixed tuition amount in installments): App Academy, App Academy Online, CodeCore Bootcamp, The Grace Hopper Program, Hackbright Academy, Nashville Software School.

- 12 schools offer income sharing agreements (students pay the school a percentage of their salary for a period of time): Academy Pittsburgh, Byte Academy, CodeCrew Code School, DigitalCrafts, devCodeCamp, Flatiron School, General Assembly, HackerYou, Holberton School, Kenzie Academy, Lambda School, Launch School, Microverse, Pursuit, Rithm School, Thinkful.

- 2 schools offer an employer-sponsorship model: Ada Developers Academy and Zip Code Wilmington.

Location (US)

As of June 1, 2019, there are coding bootcamp courses in 71 US cities and 38 states, and 14 online.

Location data is from a sample of 180 courses from all 96 qualifying schools. Table 5, Table 6, Table 7, and Table 8 refer to number of courses in each location.

| City | # bootcamp courses |

|---|---|

| New York City | 11 |

| San Francisco | 8 |

| Chicago | 7 |

| Seattle | 6 |

| Dallas | 6 |

| Denver | 5 |

| State | # bootcamp courses |

|---|---|

| California | 20 |

| Texas | 17 |

| New York | 12 |

| Ohio | 11 |

| Colorado | 8 |

| North Carolina | 7 |

| Illinois | 7 |

| Florida | 7 |

Location (Canada)

The 2019 Market Sizing Study again includes Canadian bootcamps. These 6 Canadian bootcamps graduated 888 students in 2018, will graduate an estimated 1,057 in 2019, and will generate $12,056,406 in revenue in 2019. The most popular teaching language in Canadian bootcamps is divided evenly between Ruby on Rails and MEAN Stack.

As of June 1, 2019, there are coding bootcamp courses in 7 Canadian cities and 4 provinces.

| City | # bootcamp courses |

|---|---|

| Toronto | 6 |

| Vancouver | 5 |

| Victoria | 1 |

| Montreal | 1 |

| Ottawa | 1 |

| London | 1 |

| Calgary | 1 |

| State | # bootcamp courses |

|---|---|

| Ontario | 8 |

| British Columbia | 6 |

| Quebec | 1 |

| Alberta | 1 |

Market Size: 2019 Graduates

After surveying school representatives from the 110 qualifying coding bootcamps, Course Report estimates that coding bootcamps will educate 45,592 graduates in 2019 – this includes in-person coding bootcamps, online coding bootcamps, and corporate training.

| Self-Reported Graduates | |

|---|---|

| 2019 in-person graduates (projected) | 17,524 |

| 2019 online bootcamp graduates | 5,519 |

| 2019 corporate training graduates | 22,549 |

| Total 2019 graduates | 45,592 |

Market Size: In- Person

After surveying school representatives from the 96 qualifying US/Canada-based in-person coding bootcamps, Course Report estimates a 31% growth rate for the in-person coding bootcamp market in 2019.

| Self-Reported Graduates | |

|---|---|

| 2013 graduates (actual) | 2,178 |

| 2014 graduates (actual) | 6,740 |

| 2015 graduates (actual) | 10,333 |

| 2016 graduates (actual) | 15,077 |

| 2017 graduates (actual) | 16,190 |

| 2018 graduates (actual) | 13,407 |

| 2019 graduates (projected | 17,524 |

| Estimated growth rate (2018-2019) | 31% |

| Industry growth rate since 2013 | 705% |

Market Size: Online

| Self-Reported Graduates | |

|---|---|

| 2018 graduates (actual) | 2,022 |

| 2019 graduates (projected) | 5,519 |

| Estimated growth rate (2018-2019) | 171% |

New Schools

Among the respondents, 6 schools reported “zero” graduates in 2018 (ie. the schools were new to the industry in 2018). That group expects to graduate 80 students in 2019. Among the 96 participating schools we surveyed, 70 schools expect to grow in 2019.

Closed Schools

There are 96 coding bootcamps offering full-time in-person programming courses in the US/Canada in 2019. This accounts for 7 schools that have closed or were consolidated/acquired and 5 schools that no longer qualify for inclusion in this report (see more in Participating Schools).

Participating Schools

In-Person:

Online:

| App Academy | Bottega | Covalence | |

| Coding Dojo | General Assembly | Hack Reactor/Galvanize | |

| Jax Code Academy | Kenzie Academy | Lambda School | |

| Launch School | Microverse | Thinkful | |

| V School | Woz U | ||

Missing from 2019 Study:

- Only one school refused to participate in the study: Sabio.

- 8 schools were non-responsive: New Force, Code Stack Academy, NPower, TurnToTech, PDX Code Guild, Operation Spark, Pursuit (formerly C4Q Code), and Cook Systems Fast Track'd. Zero online bootcamps were non-responsive.

- 5 of those schools – TurnToTech, PDX Code Guild, Operation Spark, Pursuit (formerly C4Q Code), and Cook Systems Fast Track'd, participated in our 2018 report but failed to respond in 2019. The industry growth rate was applied to reported 2018 graduates. To establish an “Industry Growth Rate,” we calculated the growth rate from 2018-2019 of actual reported graduates for a growth rate of 37%. We only included schools who fully participated in both 2017 and 2018.

9 bootcamps are not included in the 2019 study which were included in 2018, for a variety of reasons:

- Schools that participated in 2018 but no longer qualify for this report (ie. teach children only, changed to part-time only, etc): Hunter Business School, Dev League

- New York Code + Design Academy3, Origin Code Academy, i2 Labs Academy, CodeCraft School, CodeNinja, Coder Camps, Code Career Academy are closed.

- Note: Cincy Code IT is now MAX Technical Training, DecodeMTL is now Concordia Bootcamps.

| 2018 Coding Bootcamp Market Size Study |

| 2018 Graduate Outcomes + Demographics Study |

| 2020 Coding Bootcamp Market Sizing Report |

3 Because NYCDA closed at the end of 2018, we included 2018 graduates. NYCDA is not included in 2019 numbers.

Methodology

In our sixth annual Course Report Survey, we surveyed a total of 110 coding schools, commonly referred to as “bootcamps” or “accelerated learning programs.” Of the schools surveyed, which had to meet a set of criteria described below, 102 completed the survey, for a response rate of 93% percent. The surveys were sent to school representatives and graduation figures are self-reported by the respondents.

Criteria – In-Person. To qualify for inclusion in the survey, a school must (a) offer full-time, in-person instruction of 40 or more hours of classroom time per week, (b) not be administered by an accredited college or university, (c) provide coding-specific curriculum with a focus on Full-Stack Web Development, Mobile Development, or Front-End Web Development (a separate report will be released for schools specializing in product development, data science, design, marketing, or security), and (d) have campuses in the United States or Canada. Many schools offer courses at multiple campuses across a wide range of curriculums. Respondents were asked to only report on courses meeting the above criteria (full-time, in-person, non-accredited, programming-specific, United States/Canada).

Criteria – Online. To qualify for inclusion in the survey, a school must (a) offer full-time, synchronous, online instruction of 40 or more hours of classroom time per week, (b) not be administered by an accredited college or university, (c) provide coding-specific curriculum with a focus on Full-Stack Web Development, Mobile Development, or Front-End Web Development and (d) be instructor-led.

2019 Forecast. All participants reported the number of students who graduated in 2018. All participants also provided estimates of their expected, 2019 graduate total.

Course Analysis. In addition to survey responses, we utilized the Course Report database of individual, in-person course sections to identify a sample of 180 courses (used in Table 4 and Chart 1) from all 96 qualifying in-person schools. To qualify for our sample, the course needed to meet all of the above criteria and have a start date in 2018.

About Course Report. Course Report, founded in 2013 by Liz Eggleston and Adam Lovallo, operates https://www.coursereport.com/, which helps potential students find and research coding bootcamp programs. Course Report offers a directory of schools, course schedules, reviews and interviews with teachers, founders, students, and alumni.